First time home buyer programs low credit scores

Written by Adam Berns Jan 29 2021. First Time Home Buyer.

600 Mortgage Loan Programs Low Credit Score Mortgages Cornerstone First Financial

Your 1st CHOICE Home Loan Lender.

. Best for FHA loans. First Time Home Buyers. A 2500 or 5000 lender credit in select markets to be used toward discount points closing costs or a down payment.

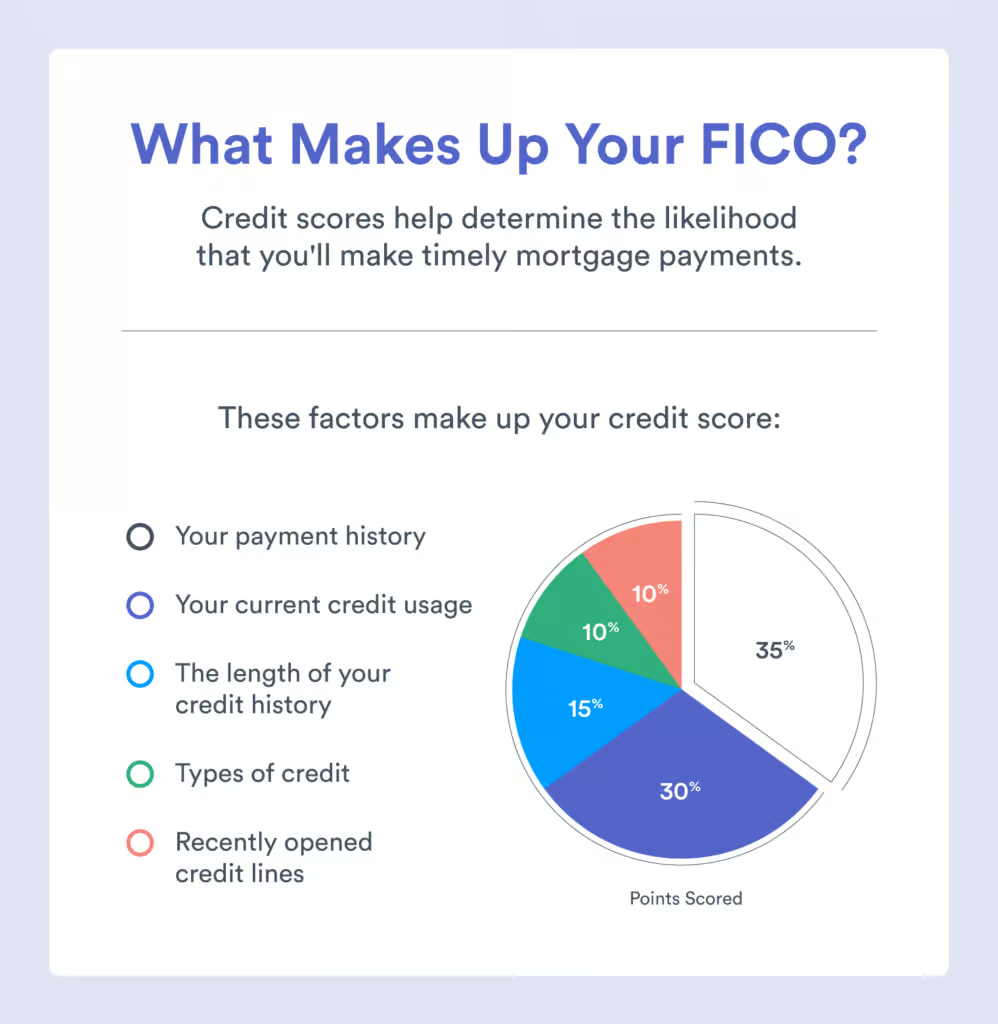

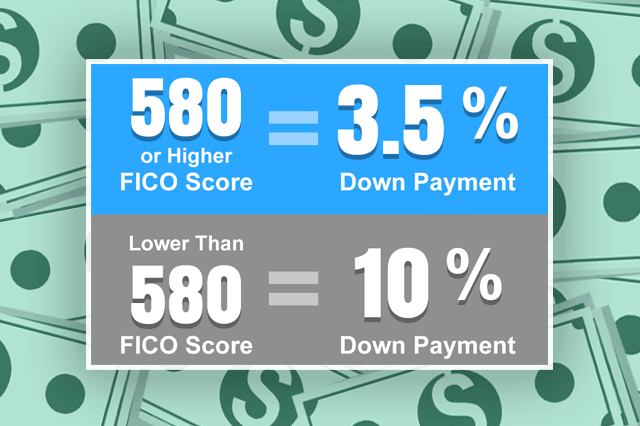

What Are the Different Types of First-Time Home Buyer Programs. If you only have cash on hand that can pay for 35 of your homes purchase price then a minimum credit score of 580 will be good enough for an FHA loan. FHA loans are the 1 loan type in America.

All across the Badger State the housing market is hot. Best for low or bad credit scores overall. Homebuyers with less than perfect credit scores can use FHA loan options.

Home Buyers with credit scores as low as 640 can use our FHA low 35. Must purchase a home within an applicable census. Home Buyers with less then credit scores can use FHA loan options.

Heres a snapshot of Florida homebuyers according to the 2021 National Association of Realtors Profile of Buyers and Sellers. Florida First-Time Homebuyer Stats for 2022. Do not have to be a first-time.

Home Buying Programs Home Buying. In as few as 30 days youll start to see. Wisconsin First-Time Home Buyer Programs and grants of 2022.

Ideal for First-Time Homebuyers Low 35 Down Payment Requirements Credit Score Requirements as Low as 580. Must be owner-occupied for the life of WHEDA loan. New American Funding.

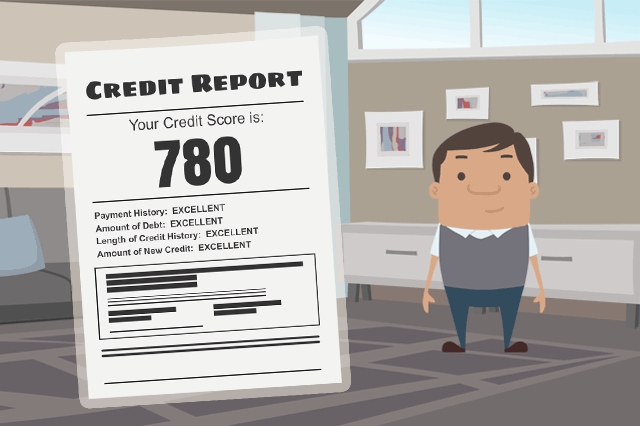

Pay your bills on time every time. The Freddie Mac Home Possible First Time Home Buyers Program is one of the best ways to get a Home Loan With A LOW Credit Score and with Zero Down PaymentWi. Property must be located in Wisconsin.

Low Down Payment Conventional Mortgages. Another terrific way to improve your credit score is to make on-time payments to your creditors. These four programs from Fannie Mae andor.

Home loans start with low Convetional 3 and FHA 35. Nurses with a credit score of 580 or higher can qualify for a. A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance but this varies.

DPA programs often exist to help first-home buyers low-income families or otherwise disadvantaged buyers. Do not have to be a first-time home buyer to utilize this program. A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance.

Home loans start with low Convetional 3 and FHA 35. Best for first-time home buyers.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans

What Credit Score Do You Need To Buy A House In 2022

Low Income Mortgage Loans For 2022

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

Fha Down Payment Requirements For Homebuyers 3 5 Or 10

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Fha Mortgage Guidelines For A Kentucky First Time Home Buyer

Minimum Credit Scores For Fha Loans

Buying A Home With Low Credit Score On Sale 52 Off Www Ingeniovirtual Com

What Is A Good Credit Score To Buy A House Or Refinance

How To Get A Bad Credit Home Loan Lendingtree

Fha Credit And Your Fha Loan In 2022

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

What Credit Score Do You Need To Buy A House In 2022 Ally

How To Buy A House With Bad Credit In 2022 Tips And Tricks

How To Buy A House With Bad Credit Nerdwallet

What Is A Credit Score Bayou Mortgage

How To Buy A House With Bad Credit Improve Your Credit Credit Org